Digital Banking Market Scope and Overview

The Digital Banking Market is poised for transformation, propelled by technological advancements, shifting consumer preferences, and regulatory reforms. In this dynamic landscape, the latest Digital Banking Market Forecast emerges as a beacon of insight, guiding stakeholders towards informed decisions and unlocking the potential for sustainable growth.

The Digital Banking Market, once characterized by traditional practices, is undergoing a profound evolution. From disruptive technologies to changing market dynamics, the industry is witnessing unprecedented shifts that demand strategic adaptation. The Digital Banking Market Forecast serves as a comprehensive roadmap, providing stakeholders with the foresight and intelligence needed to thrive in this rapidly changing environment.

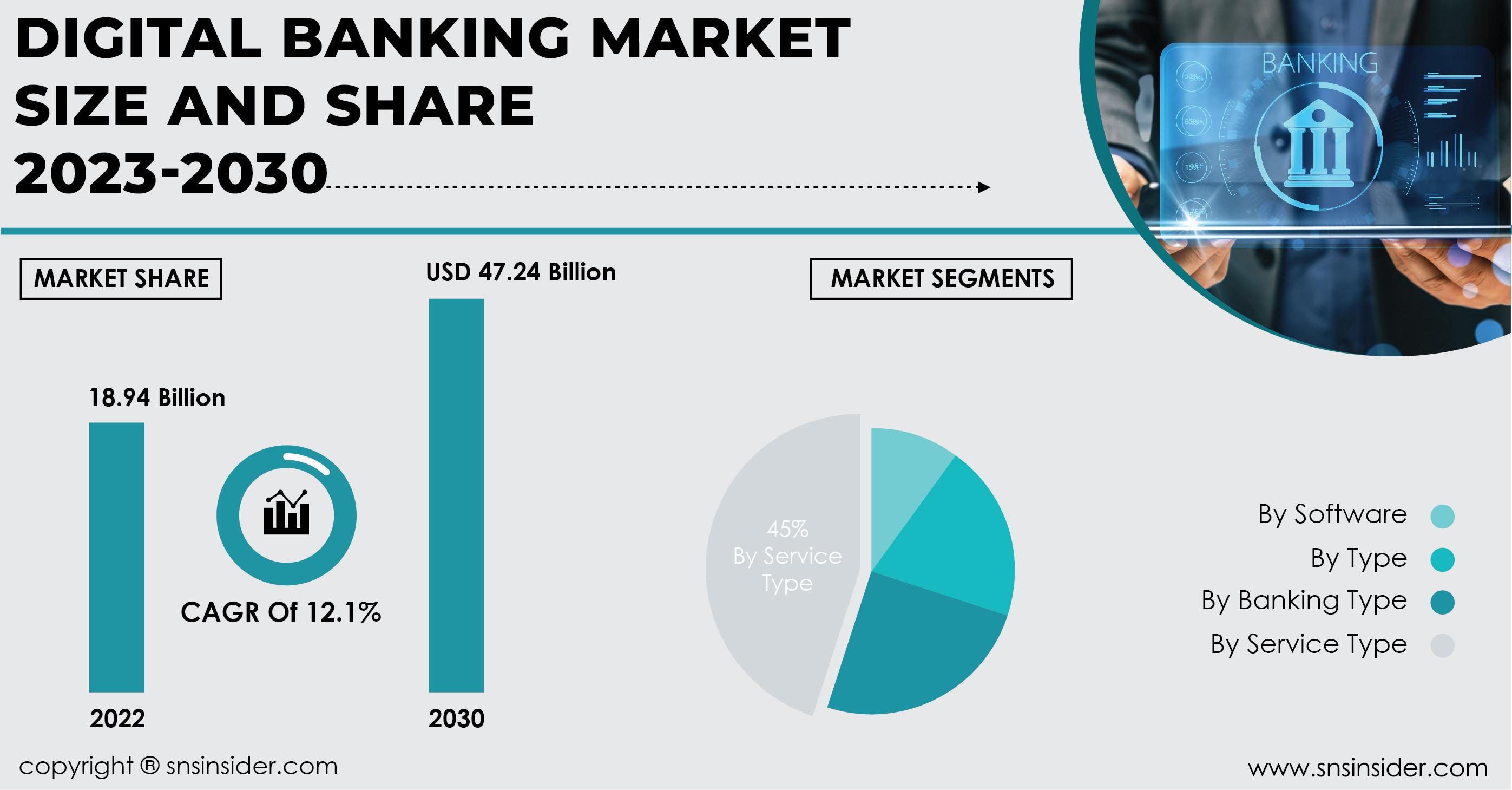

“According to SNS Insider, the Digital Banking Market size was estimated at USD 18.94 Bn in 2022, and is expected to reach USD 47.24 Bn by 2030, with a growing healthy CAGR of 12.1% over the forecast period 2023-2030.”

Get a Sample Report of Digital Banking Market @ https://www.snsinsider.com/sample-request/1256

Key Players:

The key players include ACI Worldwide, Microsoft Corporation, Fiserv, Inc., Tata Consultancy Services, Cor Financial Solutions Ltd., Oracle Corporation, Temenos Group AG, Rockall Technologies, EdgeVerve Systems Limited & Other Players

Market Segmentation

The Digital Banking Market encompasses a diverse array of products, applications, and end-user segments, each presenting unique opportunities and challenges. The forecast report delves into the intricacies of market segmentation, offering detailed insights into the various dimensions of the industry landscape.

From product-specific analysis to end-user profiling, the report provides stakeholders with a comprehensive understanding of market dynamics, enabling them to tailor their strategies to specific market segments and capitalize on emerging trends.

Market Segmentation and Sub-Segmentation Included Are:

By Type:

- Informational services

- Transactional services

- Communicative services

By Software:

- Customized software

- Standard software

By Banking Type:

- Retail Banking

- Corporate Banking

- Investment Banking

By Service Type:

- Payments

- Processing Services

- Customer & Channel Management

- Wealth Management

- Others

Competitive Landscape

In a competitive market environment, understanding the dynamics of key players is crucial for success. The Digital Banking Market Forecast offers a comprehensive analysis of the competitive landscape, profiling major players, their market positioning, strategies, and key developments.

From established industry giants to nimble startups, the report provides insights into the competitive strategies employed by market players, enabling stakeholders to benchmark their performance, identify areas for improvement, and seize opportunities for collaboration or differentiation.

Regional Outlook

The Digital Banking Market is not confined by geographical boundaries but is influenced by regional factors that shape market dynamics. The forecast report offers a detailed regional outlook, analyzing market trends, regulatory frameworks, and economic indicators across different regions.

By understanding regional nuances and market dynamics, stakeholders can tailor their strategies to specific geographies, capitalize on regional growth opportunities, and mitigate risks associated with regional variability.

Key Objectives of the Report

The Digital Banking Market Forecast aims to achieve several key objectives:

- Provide stakeholders with a comprehensive understanding of market segmentation, enabling them to identify niche opportunities and tailor their strategies for maximum impact.

- Offer insights into the competitive landscape, enabling stakeholders to benchmark their performance, identify key competitors, and devise strategies for sustainable growth.

- Analyze regional trends and market dynamics, empowering stakeholders to customize their approaches to specific geographies and capitalize on regional growth opportunities.

- Identify key objectives and growth drivers shaping the Digital Banking Market, enabling stakeholders to align their strategies with market trends and emerging opportunities.

Conclusion

In conclusion, the Digital Banking Market Forecast offers a roadmap for stakeholders navigating the dynamic landscape of the Digital Banking Market. By providing insights into market segmentation, the competitive landscape, regional dynamics, and key objectives, the report equips stakeholders with the intelligence needed to thrive in this evolving industry.

Table of Contents

- Introduction

- Research Methodology

- Market Dynamics

- Impact Analysis

- COVID-19 Impact Analysis

- Impact of Ukraine- Russia war

- Impact of Ongoing Recession on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Digital Banking Market Segmentation, by Type

- Digital Banking Market Segmentation, by software

- Digital Banking Market Segmentation, By Banking Type

- Digital Banking Market Segmentation, By Service Type

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com/

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.